|  |

HDI Seguros is part of the HDI-Gerling International Holding AG family of Talanx companies which in 2008 reported $27.5 billion dollars of premium business and is one of the most important insurance companies in Europe. HDI-Gerling International Holding AG, with more than 100 years of experience, operates in 14 countries with an income of more than 2.9 billion US dollars. In Latin America, HDI has a presence in Brazil, Chile and now in Mexico. Learn more about HDI-Gerling. Learn more about Talanx.

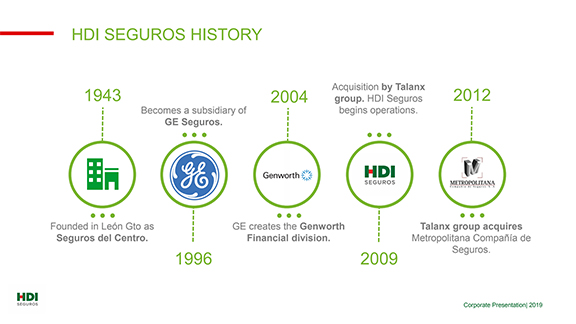

The mission of HDI Seguros, a company with sound ethical principles, is to protect people's life or property against damage or loss. Since its beginnings as Seguros del Centro in 1943, it has distinguished itself by establishing long-term relationships with its clients, and offering the best service at a fair price. This philosophy has enabled it to achieve a sustained growth and penetrate Mexico's major cities with offices of its own.

In 2009, HDI-Gerling International Holding AG acquired Genworth Seguros (now called HDI) as part of their global expansion strategy and to expand their presence in the Latin American market. HDI Seguros offers the same great service and coverage experienced with Genworth Seguros.

Map of HDI's offices in Mexico.